~ Richard Cordray, Director of the federal Consumer Financial Protection Bureau.

Funerary Genius by Frederic-Auguste Bartholdi,

creator of The Statue of Liberty

On Friday, April 15, 2016 OCWEN called and verbally informed me that they were putting my name back on the loan and would remove the block and begin reporting my perfect payment history to Transunion, Equifax and Experion. This will not undo the damage done immediately, but it is a step in that direction. Some of the damage cannot be removed.

An attorney emailed public property documents that showed that OCWEN did not just threaten to remove my name from my loan and make it a bank owned property, OCWEN swiftly, in a matter of hours, changed a loan in good standing with a perfect payment history, a loan that had just received the $5000. HAMP incentive because of that perfect payment history and $76,700.00 payment from KYHC (Keep Your Home California)....in a matter of hours OCWEN actually made this loan in good standing a bank owned property. OCWEN took my house, and all the money the government paid towards the loan to help me keep the hour, OCWEN took my name off the loan and destroyed my credit.

On Friday OCWEN called to tell me they had rescinded calling the loan due and the property was no longer bank owned, it was back in my name...but this was done "as a courtesy".

When your name is put back on your home loan "as a courtesy", this means it can be yanked away from you again, at any moment, without warning and you will lose all the money you are putting into it each month, as well as the HAMP and Hardest Hit Funds / KYHC money, that Federal money can also disappear into the OCWEN empire in a matter of hours if someone in OCWEN decides to do this again.

My request to settle this matter included a 2% HARP refinance and the removal of the upside down portion remaining on the loan. OCWEN told me they are consulting with a company they purchased, HOMEWARD RESIDENTIAL.

Perhaps if a 2% HARP refinance is done, it will take care of the ever-looming threat that even if you pay your home loan on time for six years and receive a HAMP award for your perfect record, OCWEN can still, in a matter of hours, take your home away from you and destroy your credit rating.

There isn't much choice in refinancing because OCWEN did such damage to my credit score that no lender will touch me. I have to go with a lender that OCWEN owns, HOMEWARD RESIDENTIAL.

I put the "Go Fund Me" fundraiser on hold while this refinance is being negotiated. It may not be necessary to hire an attorney if this refinance happens and the threat of having my home taken away from me even when I am making payments on time is removed by this refi.

How are we feeling? My autistic son had a very sad look on his face Friday (April 15. 2016) morning.

On Friday people kept telling me my voice was very faint. I had a sudden change in my vision around Thursday (April 14, 2016). I started experiencing flashes of light when I went from a well lighted room to a dark room. I notice it at night. I took aspirin to prevent a heart attack/stroke and rested this weekend. I will see an eye doctor about it.

James, my autistic son has a stress test on Monday at UCLA. He has cheered up some since the terrible slew of upsetting phone calls from OCWEN stopped. The past week all I did was work on trying to save our home...which was hard to do while I was taking James to his doctor appointments and trying to keep him from getting stressed by what was happening.

Without any warning and with our loan in good standing, my son and I lost our home for almost a week. It was impossible to hide the frenzy and horror from James. When he was too sick to get out of bed, he could hear me on the phone all day trying to save our home. When he as able to get out of bed he stood beside me at the fax machine.

He watched me fax documents for days. He had a few days where he was well enough to get out of bed and wanted to go outside but mostly he ended up watching mommy fax documents and make phone calls to the FBI, SEC, CFPB, HPF and other agencies that might be able to help us get our home back.

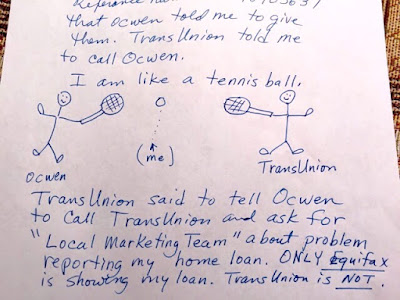

When you get your home back "as a courtesy", you don't feel safe. You feel like this:

~ TO BE CONTINUED ~